Businesses in Africa are increasingly facing new risks as investors, customers, employees, and shareholders demand greater accountability, transparency, and sustainability. Stakeholders want to know how companies are affecting the environment as well as how they treat their employees, customers, and communities. ESG risks are the environmental, social-economic, and governance variables that are likely to have a significant impact on a company’s long-term sustainability and profitability. A business that overlooks these risks could potentially incur large financial penalties and also lose investors, customers, and stakeholder support.

The Covid-19 pandemic led to investors now focusing on environmental, social, and governance (ESG) metrics as key factors in deciding who gets funding. The initial focus was on social concerns, such as the impact on short-term contract workers and employee health. However, investor and analyst expectations are driving deeper ESG-centric conversations about hard target setting, driving innovation, and the resilience of company operations.

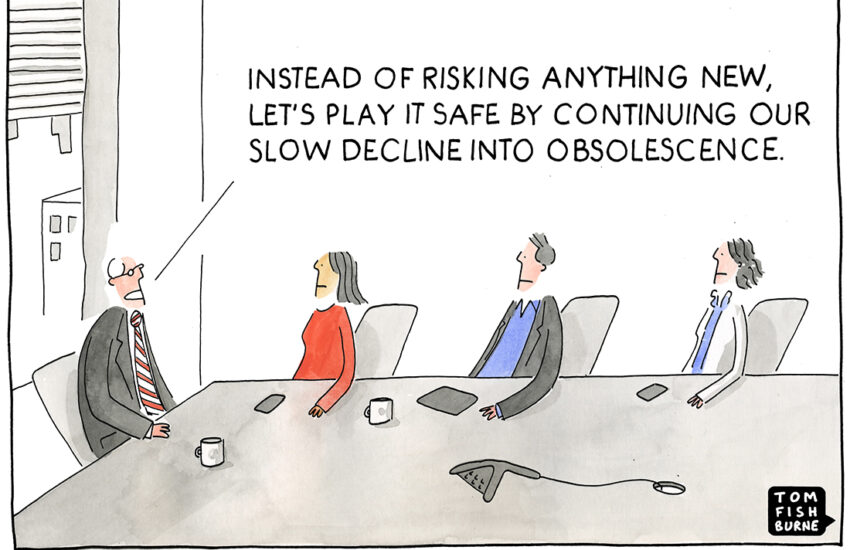

ESG-related risks are therefore becoming increasingly important considerations for institutional investors and asset managers because of mounting fears about climate change, high-profile scams, and damaging corporate governance failures. However, not all ESG issues are created equal, and their relative relevance varies by company, industry, and sector. This means each organization must identify, manage and reduce its unique material ESG risks.

The GRI Standards require the Board to outline its role in overseeing the company’s due diligence and other processes that it has in place so as to identify and manage the company’s impacts on the economy, environment, and people. Board members need to understand the specific impacts associated with their company’s ESG issues and how better stakeholder relations can mitigate these risks. By creating ESG risk management policies, directors can map out valuable areas of opportunity to create better decision-making frameworks.

Transformative ways to implement ESG risk assessments into a broader risk management framework include coordinating all responsible parties to prioritize and rank ESG risks while working with corporate leadership to determine the company’s risk tolerance across ESG matters. Next, the board should define and set ESG goals such as changing environmental practices, changing and progressing the company’s culture, or adopting a net-zero carbon emissions pledge. Defining timelines and metrics will aid in charting and measuring success as well as in determining strategies to achieve each goal. The United Nation’s 17 Sustainable Development Goals (SDGs) provide an excellent framework to leverage on. Next, the Board should allocate resources and budget accordingly and also sign off on a communications process that embeds messaging to all employees so they can buy into and own the process of communicating the ESG goals and strategy to customers, the media, and investors.

ESG is a moving target with implications that can hit hard today and last for years. It is increasingly global and interconnected and managing it with an effective ERM framework is critical. Boards should monitor ongoing risk over time, adjusting strategies through analysis of high-quality, standardized data from all the company’s ESG touch points.