I caught up with His Excellency Dr. Mukhisa Kituyi, the Secretary-General of UNCTAD in the sidelines of the Safaricom SDGs strategy launch last week. He is in town for the fourteenth session of the United Nations Conference on Trade and Development (UNCTAD 14). The session, which takes place from 14th to 22nd July 2016 in Nairobi, will bring together Heads of State and Government, ministers, and other prominent players from the business world, civil society, and academia to tackle global trade and economic development issues.

The week-long conference will feature ministerial debates, high-level round tables, thematic events, a World Investment Forum, and a Civil Society Forum, among other events. I was interested in his views ahead of the World Investment Forum on 20th July, which will feature a Sustainable Stock Exchanges Executive Dialogue on Green Finance. The Sustainable Stock Exchanges (SSE) initiative is a peer-to-peer learning platform for exploring how exchanges – in collaboration with policymakers, investors, regulators, and companies – can promote responsible investment for sustainable development. Launched by UN Secretary-General Ban Ki-Moon in New York City in 2009, the SSE offers a unique platform for CEO’s of stock exchanges, listed companies, and institutional investors, alongside high-level policymakers and regulators, to demonstrate leadership and understanding of the sustainable development opportunities and challenges facing capital markets today.

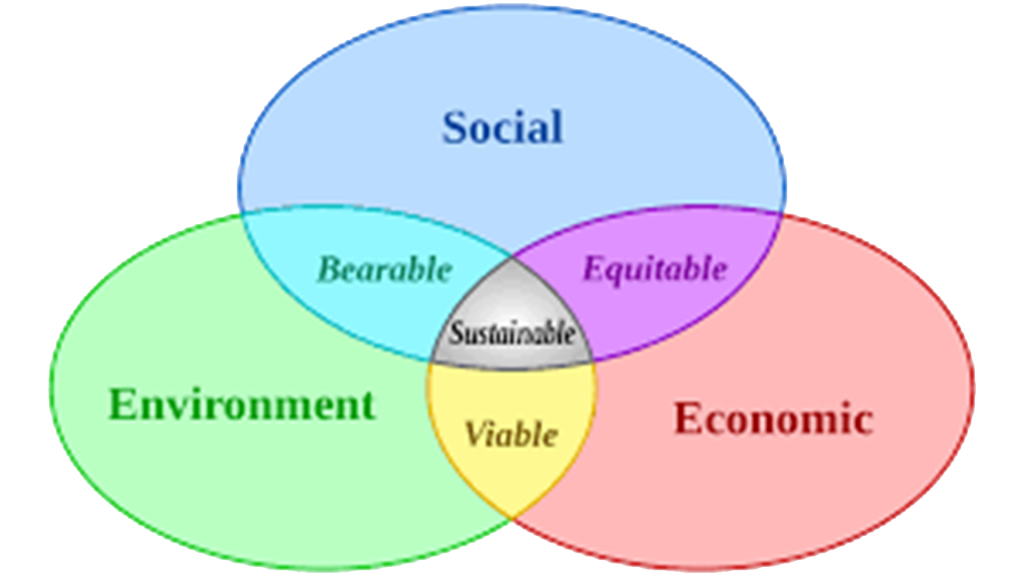

According to Dr. Kituyi, investors have shifted away from a growth-at-any-price mind-set. As part of an overall sustainability strategy, they are increasingly making demands on the good governance of the businesses they invest in. They are concerned not only about what companies declare as their profit but also what impact they are having in their production processes, what examples they are offering in gender inclusion, how responsive are they to the needs of the communities where they operate as well as how much their conduct is dignified and respectable. The SSE initiative presents stock exchanges around the world with an opportunity to voluntarily sign up for a peer review process that identifies how much their behavior reflects their commitment. Dr. Kituyi stated that this is a model in which businesses cultivate their own voluntary standards is an important start to the setting of ‘soft law’ against which governments can now create regulations that are not overbearing but represent the best interests of business and corporate governance.

It is significant that this dialogue on ‘Green Finance’ is taking place in Kenya where the corporate landscape is witnessing a dramatic shift. Increased transparency powered by changing consumer attitudes has exposed poor governance practices leading to the eroding of stakeholder trust. This is primarily due to recent occurrences where potential corporate governance malpractices may have contributed to significant losses to the investing public. The companies that have recently incurred investor losses relating to corporate governance include CMC, Imperial Bank, Uchumi, Mumias, Kenya Airways, TransCentury, Chase Bank, and NBK. For a market with over 60 listed companies to have significant issues with at least 8 companies equates to about 13% of listed companies with corporate governance issues. In as much as these cases of corporate governance are not systemic, they have negative effects on investor confidence and market sentiment.

The Capital Markets Authority (CMA) recently enacted a new Corporate Governance Code for listed companies in Kenya. The Code “sets out the principles and specific recommendations on structures and processes, which companies should adopt in making good corporate governance an integral part of their business dealings and culture” (CMA, 2015). It advocates that companies adopt standards that go beyond the minimum prescribed by law, and sets out specific recommendations on the structures and processes they should adopt in order to make good corporate governance an integral part of their business. Currently, the Code is articulated in a detailed set of principles, recommendations, and guidelines that cover all relevant aspects of corporate governance. The Code can be seen as the start of an evolutionary process of embedding a culture of corporate governance, ethical business, and sound environmental and social practices throughout the Kenyan private sector in line with global best practice.

The sustainable development agenda culminated last year with the UN climate summit (COP21) where world leaders demonstrated the necessity for collective action on climate change. The momentum of this global agreement carries over to 2016, which sees the G20 Green Finance Study Group and the Financial Stability Board’s (FSB) industry-led disclosure task force on climate-related financial risks. Together these initiatives indicate the growing importance policymakers now place on the finance community’s contribution to the global climate agenda. The SSE Executive Dialogue on Green Finance will address key elements of the new global agenda on green finance, and evaluate what role stock exchanges can play. New and renewed commitments from stock exchanges and regulators in the region will promote green finance and improved corporate sustainability reporting. The session will call for a specific action from exchanges and regulators on Sustainable Development Goal (SDG) no. 13.3 regarding climate change awareness, mitigation, adaptation, and impact reduction, and SDG 12.6 regarding the promotion of sustainability reporting. The issues to be addressed include the role of regulators, investors, and stock exchanges in bringing forward innovative financing mechanisms for a green economy, advancing responsible investment and good corporate practices on ESG and climate change (SDG 13.3), and sustainability reporting (SDG 12.6).

Dr. Kituyi applauded Sustainability Marketing Africa for leading the way in raising consciousness that companies have to play a much bigger role in sustainable corporate governance and conduct than ever before. He hopes other enterprises will emulate this example.