A couple of years ago, Assaad Razzouk, chief executive of renewables firm Sindicatum delivered a sobering but hilarious reality check to the sustainability community at the Eco-Business “Will businesses drive the SDGs?” event in Singapore when he suggested: It’s very clear that businesses are fast asleep at the wheel [with regards to sustainability] and that 99 percent or more think SDGs stand for a sexually transmitted disease! Assad’s take on the business response to sustainability may be humorous but there may also be some truth to it. The business community is increasingly under pressure to report on sustainability and yet it continues to be in denial of this fact.

In 2015, the Kenyan Capital Markets Authority (CMA) introduced the Code of Corporate Governance, which articulates a detailed set of principles, recommendations, and guidelines for best practice corporate governance. This code which came into effect in 2017, takes an “ apply or explain” approach and requires listed companies to adopt a range of new policies and strategies –including broad sustainability strategies and report on how these strategies are being executed by adopting Sustainability Reporting.

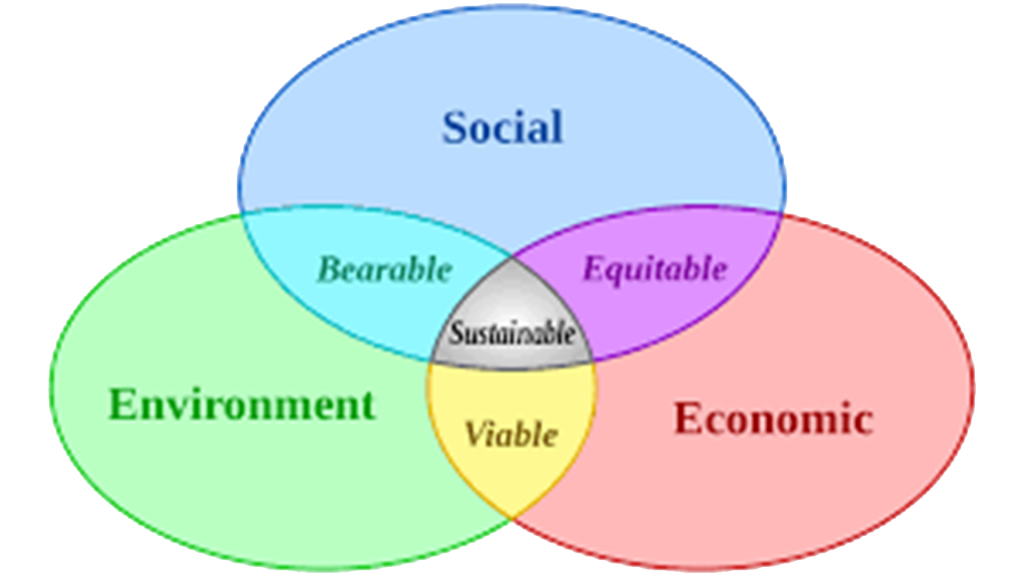

Financial information is only the tip of the iceberg when it comes to information relevant to an investor as it provides only historical-oriented information on a narrow financial base that is insufficient to assess a company’s ability to generate future profits. Materiality in sustainability reporting includes considering economic, environmental, and social impacts that cross a threshold in affecting the ability to meet the needs of the present without compromising the needs of future generations. Integrating sustainability and financial reporting (integrated reporting) is an evolution of financial reporting, with a focus on conciseness, strategic relevance, and future orientation. In developing their sustainability and integrated reports, most companies in Kenya tend to use the GRI Sustainability Reporting Standards (GRI Standards), which are the first and most widely adopted global standards for sustainability reporting. According to GRI, the practice of disclosing sustainability information inspires accountability and helps identify and manage risks.

The flipside of risk is opportunity and innovation.

Long-run waves of innovation can be observed since the industrial revolution. Many believe that we’re entering the sixth wave of innovation by transitioning towards sustainability and integrated reporting. One of the notable things about these waves of innovation is that they created enormous wealth for the companies that were early adopters. A business might therefore decide not to pay much attention to sustainability reporting, but others will. Those investing now in resource productivity, re-use, leasing, and smart design – the outcomes of sustainability reporting over time – are going to have a major head start.

Initiatives such as the CMA Code of Corporate Governance are asking for companies to provide a holistic vision of how their operations and strategies are taking into account the environmental, social, and governance risks and opportunities.

Every day, decisions are made by businesses and governments which have direct impacts on their stakeholders, such as financial institutions, labor organizations, civil society and citizens, and the level of trust they have with them. These decisions are rarely based on financial information alone. They are based on an assessment of risk and opportunity using the information on a wide variety of immediate and future issues.

The value of the sustainability reporting process is that it ensures organizations consider their impacts on these sustainability issues and enables them to be transparent about the risks and opportunities they face. Stakeholders also play a crucial role in identifying these risks and opportunities for organizations, particularly those that are non-financial. This increased transparency leads to better decision making, which helps build and maintain trust in businesses and governments.

A few years ago, a cute animated film about an obsolete mobile phone facing an existential crisis beat big-budget corporate advertisements to win a coveted Melbourne Design Award for best animation. But the film — titled Life Pscycle-ology and produced by small-scale eco-design and consultancy company Eco Innovators — was more than a mobile telephony soap opera. It educates the design community on its responsibility to create more sustainable products. The creators of the film say that people have the perception that sustainability is about going back to the dark ages while it is actually about valuing the things we did right and the things that we need to hold onto, like the ability to repair and the creation of products that are designed to be repaired.

Perhaps, this simple definition of sustainability may explain it for most of us, but what does it mean for business?

Sustainability is not the same as Corporate Social Responsibility (CSR). While CSR lays a strong focus on philanthropy and corporate giving, sustainability is part of the business strategy. It uses day-to-day management decisions to address social, economic, and environmental issues arising out of the company’s operations. Sustainability involves measuring the impact with the aim of improving business performance.

Each year, the World Economic Forum publishes the Global Risks Report. Through working with experts and decision-makers across the world to identify and analyze the most pressing risks that we face, the report inevitably tends to highlight the accelerating pace of change, and the deepening risk interconnections.

Take, for instance, the general call by society for companies to broaden their mission by communicating how they create returns for shareholders, but also how they are creating long-term value for all stakeholders – including society and the environment. Millennials feel even stronger. A global survey by Deloitte in 2016 showed that 87% of Millennials around the world believe that “the success of a business should be measured in terms of more than just its financial performance.” This generation — which will be 50% of the workforce by 2020 — seeks employers that share their values.